Buy more shares in your home

- Home

- Find a home

- Home owners

- Shared owners

- Buy more shares

Are you thinking of buying more shares in your home?

Great news! We've extended our offer to help you move onto the next stage of your home ownership journey.

For new applications, we will pay up to £650* towards your legal fees when you buy more shares in your home and complete your purchase by 30 June 2024.

Take a look at our roadmap or reach out to your neighbourhood coach for more details.

*Ts&Cs apply

Our guide to buying more shares in your home.

Most people dream of owning their own home and we’re happy you made the step towards this when you bought your home through Shared Ownership.

As a shared owner you may be able to buy more shares* in your home depending on the terms of your lease. This is called staircasing and enables you to increase your share in your home. You can purchase additional shares in one go or over time, but the price you pay will always be based on the current market value of your home.

There are a number of benefits to staircasing out of your property which include:

- You reduce the amount of rent you pay, with no rent to pay if you have staircased to 100%.

- If you have staircased to 100%, you are not restricted by the criteria of your lease and can sell your property on the open market using an estate agent of your choice.

- Staircasing to 100% means you can sell your home to anyone who is interested. You are not restricted to someone matching the eligibility criteria for Shared Ownership.

- When you decide to sell your home, the higher your share, the more profit you will make if the value of your home has increased. Please bear in mind that the value can go down as well as up.

With Stairpay you can calculate your staircasing affordability to get an overview of monthly payments based on your staircasing goals.

To find out if you have enough equity in your home to buy extra shares, and for an estimate of how much a new mortgage might cost it is best to contact an independent financial advisor for guidance. TMP Mortgages or Mortgage Advice Bureau can offer any support you may require. Alternatively, you can also find a financial adviser or mortgage adviser, near to you on the Financial Services Register.

*Most leases will allow you to buy up to 100% of the property. We will check this when you apply.

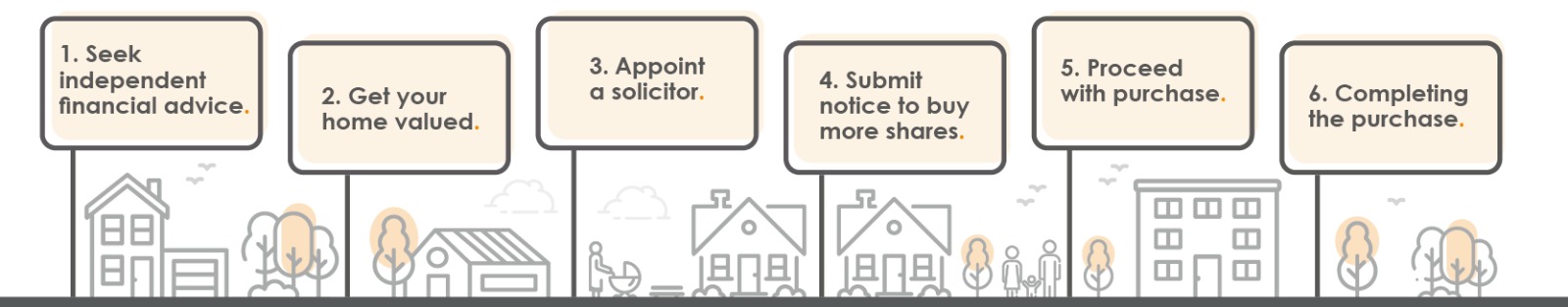

How does it work?

-

Step 1. Seek independent financial advice

You will need to ensure that buying further shares is the right choice for you and will remain affordable in the future. The exact amount will depend on the type of mortgage and the lender.

-

Step 2. Get your home valued

You will need to instruct an independent surveyor registered with the Royal Institute of Chartered Surveyors. You can instruct a RICS surveyor of your choice. An estate agents market appraisal will not be acceptable.

We have a panel of surveyors detailed below who understand our requirements for your RICS valuation report, or you can choose a surveyor near to your home by searching the RICS website.

Whitestone Commercial Ltd

Sussex Place

Widcombe

Bath

BA2 4LA

Contact: Tess Lambert

E: tesslambert@whitestonecommercial.co.uk | T: 01225 436464Property Services (Midlands) Ltd

8 Wolverhampton Road

Cannock

WS11 1AH

Contact: Ben Greaves

E: survey@jayman.co.uk or survey centre@jayman.co.uk | T: 01543 505566You will need to pay the fee for the valuation report directly to your chosen company.

-

Step 3. Appoint a solicitor

As you are legally purchasing more of your home you need to appoint a solicitor. This can be your own solicitor or one from our panel. You should ideally look for someone who is experienced in Shared Ownership leases and charges a fixed fee.

Our panel of solicitors are familiar with our shared ownership products and conveyancing process. Please feel free to contact:

Talbots Law

New Enquiries Team

E: newenquiries@talbotslaw.co.uk | W: www.talbotslaw.co.uk | T: 0800 118 1500

Talbots Law feesDavies & Partners Solicitors

Kerry Raymond

E: kerry.raymond@daviesandpartners.com | W: www.daviesandpartners.com | T: 01454 619619

Davies & Partners fees

You can find a solicitor near to you that is qualified to offer conveyancing, on The Law Society's register. -

Step 4. Submit the notice to buy more shares form

Please have the following documents ready to upload:

- Signed consent of any work we have permitted on the property

- Your independent market valuation undertaken by a Royal Institute of Chartered Surveyors (RICS) valuer.

- We will instruct our solicitor on receipt of your Notice to Buy more shares form

- You have three months from the date of the valuation to buy your shares

-

Step 5. Proceed with the purchase

Based on the RICS valuation and the additional share of your property you wish to purchase, you will then receive confirmation from us, detailing how much this extra share will cost. You can now share this with your solicitor who will then work towards completing the purchase. You have three months from the date of the valuation to buy your shares.

-

Step 6. Complete the purchase of your home

On completion we will send out a completion statement confirming your increased share in the property. If you are not purchasing up to 100% ownership your new rent payments will also be confirmed.

-

FAQs

How is the purchase price calculated?

When you decide to staircase, you buy additional shares at the current market value of the property. You will need to arrange the valuation with a RICS registered surveyor. They will visit your home and provide a report that will detail how much your property is worth, this is called the market value. The cost of shares is calculated on the market value of your home.

What about improvements made to my home?

You should notify the valuer of any improvements you have carried out with our written permission. The valuer should disregard these improvements when considering the valuation figure if you are staircasing to 100%.

What improvements qualify?

Improvements such as newly fitted kitchen, bathroom, central heating, loft conversion, double-glazing and conservatories will be considered providing consent was given by your landlord. General repairs, maintenance or redecoration are not considered to be improvements.

How long is the valuation valid?

The valuation is valid for three months. If you don’t complete the staircasing within this timescale an updated valuation will be required and an additional charge may apply.

Can I buy more shares if my rent is in arrears?

Yes, you can still buy more shares if you have fallen behind on paying your rent, but you will have to pay off your arrears as part of the purchase.

What else will I need to pay?

As well as the valuation fee and our administration fee, you will be responsible for your solicitor’s costs, mortgage arrangement/valuation fee (if applicable) and possibly stamp duty

Will my rent payments alter?

If you are partially staircasing, the amount of rent you pay will reduce in line with the additional shares purchased. If you staircase to full ownership, you will no longer have to pay rent to us, however a service charge and/or ground rent may still be payable.

What about service charge and buildings insurance?

If your home is transferring to a freehold tenure you will need to arrange your own buildings insurance. Any service charge is still likely to be payable. However, if your home is to remain leasehold, your buildings insurance and service charge will remain unaffected.

How soon can I staircase?

You can buy additional shares in your home whenever you are in a position to purchase more shares.

In most cases, the lease permits staircasing to 100% unless restrictions apply by the lease terms and/or planning conditions.

Are there any restrictions on staircasing?

Restrictions on staircasing are determined by the individual leases. This includes rural restricted staircasing schemes, protected area schemes, and fixed equity schemes, as no additional shares may be purchased.

Most leases permit staircasing in at most three stages until the maximum % share owned is reached. However, Bromford is happy to review requests to purchase additional shares in more than three stages where it can be demonstrated this is affordable for the shared owner.

When is the best time to buy more shares?

Whilst the best time to purchase more shares is a personal decision, it’s often a good idea to consider it when you are looking to re-mortgage your home, for instance at the end of a fixed-term deal. Factoring it in at this point means you probably won’t have to pay additional redemption fees that can be associated with changing your mortgage part way through an agreement.

How can I pay for additional shares?

Our customers often buy additional shares or buy their shared ownership home outright when their circumstances change. This could be through inheritance, a change of job that enables you to secure additional funds through re-mortgaging or you may have managed to save some money over time and want to use your savings to purchase more shares.

Do I need to get a mortgage in place before I contact Bromford?

Affordability is one of the biggest considerations when purchasing additional shares, so you do need to make sure your finances are in place before you contact us. If you are purchasing a proportion of the remaining shares, you will need to email a copy of your mortgage offer along with your valuation.

How many shares can I purchase?

Your lease will the minimum amount you can purchase at one time however, we’re flexible and are happy to work with you to help you purchase the amount you require.

What costs are associated with staircasing?

There are several costs to consider when purchasing more shares:

Valuation fees – The cost of valuation depends on several considerations including the size and location of your home. Recent research suggests a survey can cost anything between £290 - £1390 and you pay this fee directly to the surveyor.

Solicitors’ fees – There is a cost associated with instructing a solicitor to act on your behalf. This fee is paid directly to the solicitor.

Mortgage fee – If you are re-mortgaging to pay for additional shares, your lender is likely to charge a fee for the product. If you are mid-way through a mortgage fixed term there might also be a redemption fee. So, it’s definitely worth checking on all of this before you get started.

Do I still have to pay service charges and rent when I Staircase?

If you become a freeholder by purchasing 100% of the shares in your house you will no longer pay rent, However, you will continue to pay service charges if it was previously payable on your property.

If you purchase an apartment outright by purchasing the remaining shares, you will no longer pay rent but will continue to pay service charge.

We will provide you with this information when we write to confirm whether you can purchase additional shares.

Do my responsibilities change when I Staircase?

If you purchase all the remaining shares in your house so that you own it outright, you will be responsible for securing Buildings Insurance for the property. If you are purchasing an apartment, your responsibilities relating to Buildings Insurance will not change.

If my circumstances change can Bromford buy the shares back?

Occasionally there is a ‘buy-back’ clause in the lease agreement, however for the majority of homes Bromford will not buy the shares back.