02 January 2018

Why we must build resilient communities, not just new homes

Chief executive Philippa Jones recently spoke at a conference in London where she and other panellists were asked the question: "How will local…

The content in this article may now be out of date. Please try searching for a more recent version.

With the release of our latest set of accounts, we’re often asked how Bromford remains so financially secure that we’re able to up investment in customer service at a time when most are cutting back. Here, chief executive – Philippa Jones - shares her view on how that strength has been built up over the years so that we can now increase investment in both homes and services despite the challenges of rent cuts and welfare reform.

I’ve been here at Bromford for 28 years so I know that we’ve always practiced tight cost control and focused on efficiency. We work hard to scan the horizon to see what’s coming and more importantly to take preventative action, so we’ve been prepared to make some of the tough decisions a lot earlier than many others. For instance in the wake of the Credit Crunch back in 2009 we cut our costs significantly by streamlining our operational, legal and governance structures in ways others are only just starting to do now. That’s driven years of strong margins and put us in a much better financial position now.

Back when we were looking at the DNA of the organisation and considering what’s made us successful, it was obvious that colleague awareness of value was key and so it was no surprise that ‘be commercial’ entered into our core principles. I often find that at first these words don’t resonate with a lot of colleagues. You see it at induction when we ask new colleagues which of Bromford’s DNA strands they most identify with – Be Brave, Be Commercial, Be Different and Be Good. Often people are uncomfortable with ‘Be Commercial’, until I say to them: “think of it as the opposite of being wasteful” and then they get it. Our colleagues have grown up looking at value and phrases such as “is this the most effective use of my time?”, “release your inner-accountant” and “would you spend your last £100 on this” are common place. ‘Be Commercial’ isn’t a barrier to ‘Be Good’, it’s the essential enabler. Our value for money approach is all about doing the basics very cost-effectively so we retain as much as possible of our rental income to invest either in new homes or in services that really make a difference to customers’ lives.

A more recent development in this culture of commerciality is the idea of taking control and being resilient. It’s something that we explicitly encourage with our customers through the Bromford Deal relationship, preparing them to thrive despite a shrinking welfare state. But it’s equally true that it’s the financial resilience of our business that can enable us to control our own destiny, making our own investment choices at a time when other organisations are significantly scaling back.

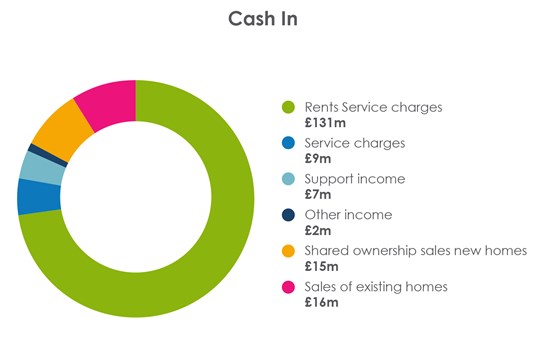

Our key financial objective continues to be that we operate basic services as efficiently as possible to maintain or improve our financial strength, whilst protecting our cash so that we can invest in new homes and services. This focus on cash rather than profit is also a really important point. With the change in accountancy rules I think it’s fair to say that financial performance has become more opaque than ever to anyone reading a set of HA accounts. But cash is real so this is what we track, and it’s this that gives us the financial backbone to make those ambitious investment decisions:

As of March 2016 we had:

With this behind us we are resilient and in control. We can manage the risks of Welfare Reform, of rent cuts and of uncertainty around future rent models. We can ensure that we have enough to cover the bullet payments on our loans, but importantly we can also invest in the things we think matter, the things we’ve outlined in our latest strategy – increasing the supply of new homes, ensuring our customers have the right home for them and building a trusting and productive relationship with our customers.

These investments certainly include building more new homes, but even more significant for us is the launch of our new localities approach which will see Neighbourhood Coaches with patches of around 175 households replacing traditional Housing Managers who each look after 500 households. Last year we invested £1.1m in testing it, and following a successful pilot we’re rolling it out at a cost of £3.5m. It’s this freedom to act and think differently, to be in a position to invest in the innovation and the insight to see whether something can make a significant and sustainable difference to customers and communities that’s so important. That is the reward for driving that commercial culture right through the core of our business.

02 January 2018

Chief executive Philippa Jones recently spoke at a conference in London where she and other panellists were asked the question: "How will local…

11 February 2016

It was like any other Tuesday afternoon and then I got the call. Bromford had been chosen as one of the very first to receive a real IDA following the…